Home

Salary Vs Hourly California . An hourly worker receives an hourly wage for their services. Exempt salaried employees may not be eligible for overtime;

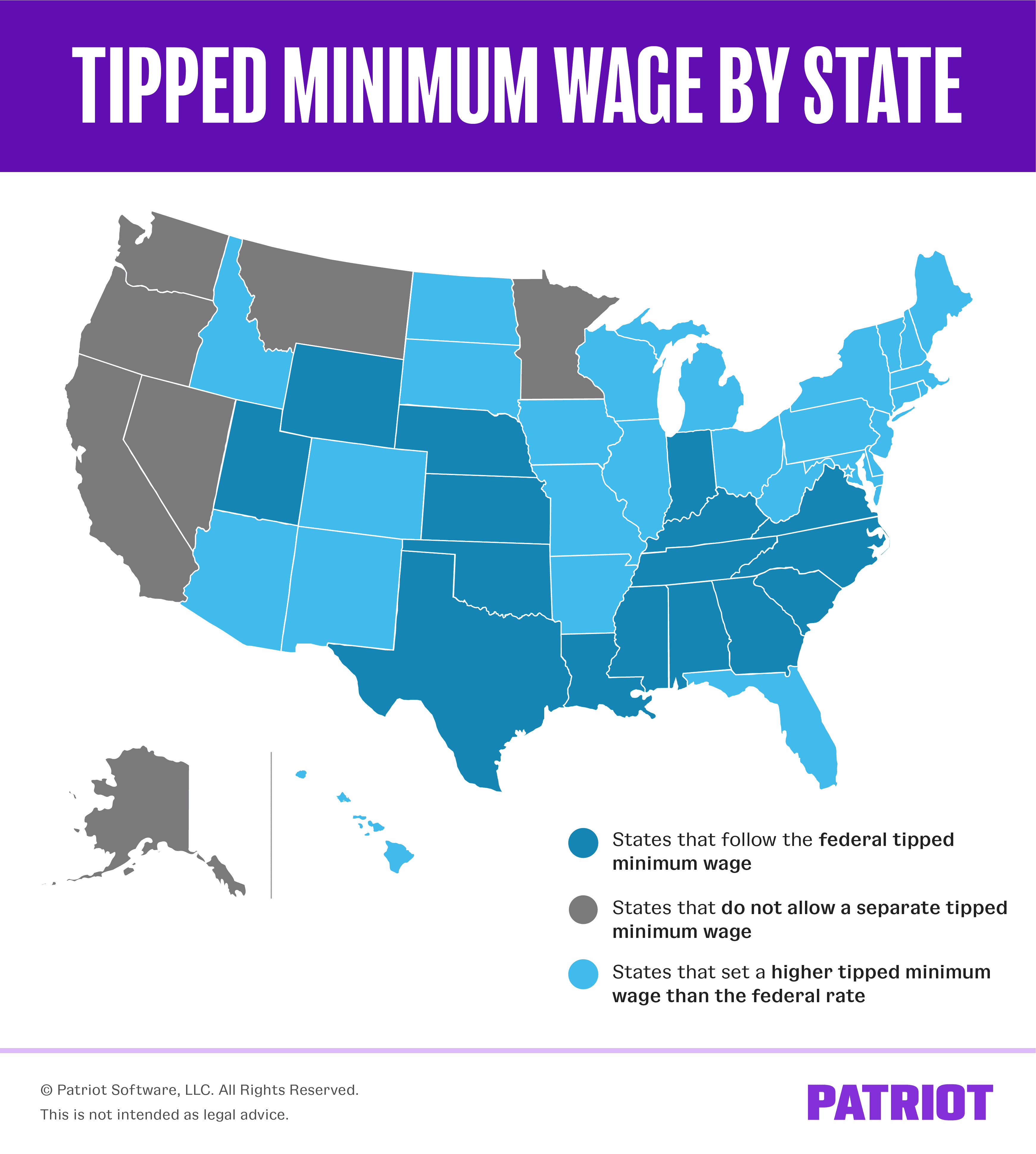

Tipped Minimum Wage Federal Rate And Rates By State Chart from www.patriotsoftware.com Ability to dedicate time to other interests 4. Nonexempt status, salespeople are grouped into two categories: But some employers pay hourly employees a fixed salary, such as $1k per. Since you don't, you are automatically a nonexempt employee eligible for overtime. An hourly employee works 45 hours for the period.

After all, there is a stigma associated with using a punch clock and tracking all of the hours you work. 40 regular hours x $10.00 per hour = $400 regular pay. You may also want to convert an hourly wage to a salary. A salaried employee is defined as a worker who receives a fixed amount of compensation paid weekly, biweekly or monthly. After all, there is a stigma associated with using a punch clock and tracking all of the hours you work. Many employees in california believe that it is better to receive a salary as opposed to being paid on an hourly basis. They get paid time and a half for overtime hours.

Source: www.lc-lawyers.com Salaried employees are usually not paid based on the hours they work; Their hourly rate is $10.00 per hour. Salaried employees are usually not paid based on the hours they work;

Instead, they are paid the same amount each pay period, based on their total salary. Employees are classified by salary versus hourly and by the kind of work they do. 40 regular hours x $10.00 per hour = $400 regular pay.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. California, for instance, requires employers to pay exempt employees a salary equal to twice the current minimum wage for full time employment, which, for an employer of 26 or more employees, currently means $54,080 annually. But some employers pay hourly employees a fixed salary, such as $1k per.

Source: m.foolcdn.com As a new grad i'm going to request 62 dollars an hour or a 115,000 annual salary plus 20% bonus for profits above 2 times my salary. Nonexempt status, salespeople are grouped into two categories: They get paid time and a half for overtime hours.

If you meet the criteria to be exempt as a computer professional, then you can be paid on an hourly basis (an exception to the exempt employees must be paid a guaranteed salary requirement) if you make the appropriate hourly rate. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. 40 regular hours x $10.00 per hour = $400 regular pay.

Some autonomy over your schedule. The majority of other employees should receive pay at no less than twice a month and at least the state's minimum hourly wage. Department of labor salary vs hourly definitions.

Source: www.maloneyfirm.com In general, an employee has to make at least $684 per week ($35,568 per year), be paid on a salary basis, and perform exempt duties. Paid time off and sick days 3. You may also want to convert an hourly wage to a salary.

For purposes of defining exempt vs. A salaried employee is defined as a worker who receives a fixed amount of compensation paid weekly, biweekly or monthly. Moving from hourly to salary additional challenges.

A salaried employee gets paid on the basis of a predetermined annual amount. After all, there is a stigma associated with using a punch clock and tracking all of the hours you work. The law requires a specific hourly, monthly or yearly salary which is set by the state of california each year.

Source: media.beam.usnews.com Since you don't, you are automatically a nonexempt employee eligible for overtime. But some employers pay hourly employees a fixed salary, such as $1k per. For purposes of defining exempt vs.

Because of that, it allows you to focus on family commitments or other job commitments. An hourly employee is paid $9.62 an hour. I also want full medical, dental, 401k, 4 weeks pto and extra pay for when i take call.

But, an hourly employee moving to a salaried job most frequently takes on the responsibility for the department they may formerly have just worked in. (monthly salary x 12) / 2,080. Living wage calculation for california.

Source: www.optnation.com Also you may want to see if you have one of the 50 best jobs in america. An hourly employee works 45 hours for the period. Their primary work (more than 50%) should be focused on executive, administrative, or professional duties.

Their hourly rate is $10.00 per hour. An hourly employee is paid $9.62 an hour. The majority of other employees should receive pay at no less than twice a month and at least the state's minimum hourly wage.

If you meet the criteria to be exempt as a computer professional, then you can be paid on an hourly basis (an exception to the exempt employees must be paid a guaranteed salary requirement) if you make the appropriate hourly rate. Ability to dedicate time to other interests 4. Nonexempt status, salespeople are grouped into two categories:

Source: files.epi.org Subject to the california labor law, exempt salaried employees should be paid at least monthly at no less than twice the minimum hourly rate. Subject to the california labor law, exempt salaried employees should be paid at least monthly at no less than twice the minimum hourly rate. Different tests for exempt status apply to each one.

Employers compensate employees either by paying them an hourly wage or an annual salary. Paid time off and sick days 3. Living wage calculation for california.

Subject to california's minimum wage laws; But some employers pay hourly employees a fixed salary, such as $1k per. The rules contained in the act are enforced by the agency's wage and hour division, which is also responsible for investigating.

Thank you for reading about Salary Vs Hourly California , I hope this article is useful. For more useful information visit https://labaulecouverture.com/